Our Blog

Articles full of helpful tips, stories, and news.

Understanding Depreciation and Its Impact on Financial Statements

In this comprehensive article, we delve into the concept of depreciation and its significance on financial statements. Explore its impact, how it affects businesses, and its relevance in accounting practices.

Choosing the Right Business Entity: A Guide for New Entrepreneurs

Are you a new entrepreneur trying to establish your business? This comprehensive guide on "Choosing the Right Business Entity" will walk you through the key considerations and provide expert insights to help you make informed decisions.

Tips for Effective Cash Flow Management in Small Businesses

Learn essential tips for effective cash flow management in small businesses. Discover expert insights and strategies to optimise your cash flow, ensuring business stability and growth.

Understanding Business Expenses: What Can and Cannot Be Deducted

Running a business involves various costs, from day-to-day operations to marketing and employee salaries. While all expenses impact your bottom line, not all of them are deductible for tax purposes.

Choosing the Right Accounting Software: Factors to Consider for Small Businesses

In the digital era, accounting software has revolutionised the way businesses manage their finances. It streamlines financial processes, increases efficiency, and provides accurate insights into business performance.

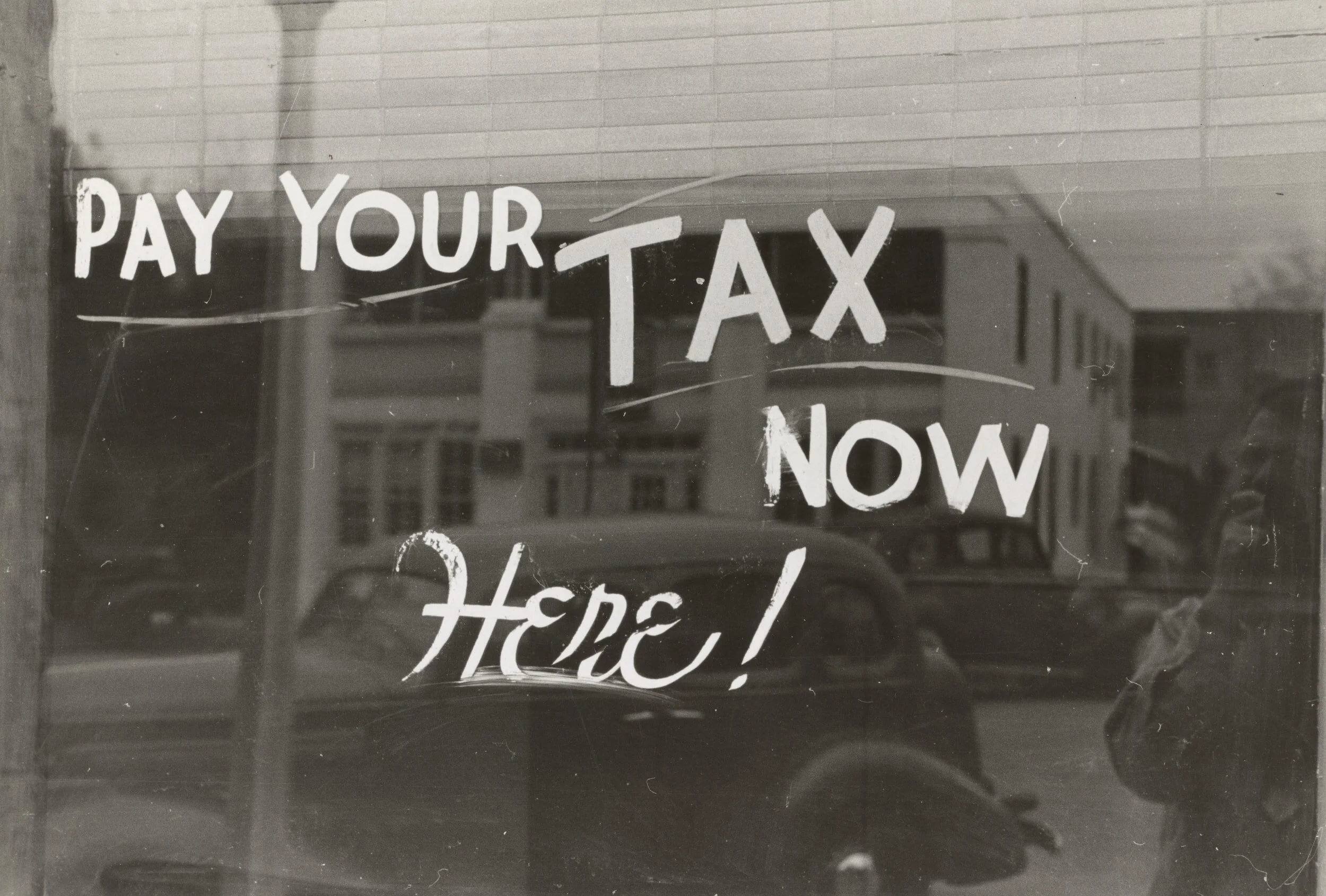

The Consequences of Tax Evasion: Legal, Reputational, and Financial Risks

Tax evasion undermines the integrity of the tax system and deprives governments of the funds needed to provide essential public services.

Transparent Pricing: Building Trust and Integrity with Customers

One key factor that plays a vital role in fostering trust is transparent pricing. When businesses openly communicate their pricing structure, customers feel more confident and empowered in their purchasing decisions.

QuickBooks vs. Xero Which One Is Right for Your Business?

QuickBook and Xero offer a range of features designed to streamline financial management processes. However, choosing the right software for your business can be a daunting task.

Spreadsheets for Small Business Accounting: Pros, Cons, and Best Practices

Spreadsheets have been a go-to tool for managing finances for decades. With the rise of technology, however, there are now many software solutions available that offer more advanced features and automation.

Effective Tax Planning Strategies for Year-End: A Guide for Individuals and Small Business Owners

As the year draws to a close, it's essential for individuals and small business owners to consider tax planning strategies to maximize their savings and minimize their tax liabilities. By taking proactive steps before the year ends, you can position yourself for financial success and make the most of the available tax benefits.

Top 7 Tax Deductions for Small Business Owners

Understanding the tax deductions is like discovering a hidden treasure chest, allowing you to optimize your business's financial health.

The Importance of Maintaining Accurate Financial Records for Businesses

Just like the heartbeat of a business, the financial records provide vital insights into its financial health and pave the way for informed decision-making. So, let's embark on this enlightening journey!

Differences Between Financial and Management Accounting

The two branches of accounting (Financial and Management Accounting) may seem intertwined, but they possess unique qualities that shape the financial landscape for individuals and businesses. So, let's set forth on this captivating voyage of knowledge.

The Importance of Bookkeeping: When Should Business Owners Prioritize It?

There are numerous aspects to manage, from operations and sales to marketing and customer service. However, one critical area that often gets overlooked or neglected is bookkeeping.